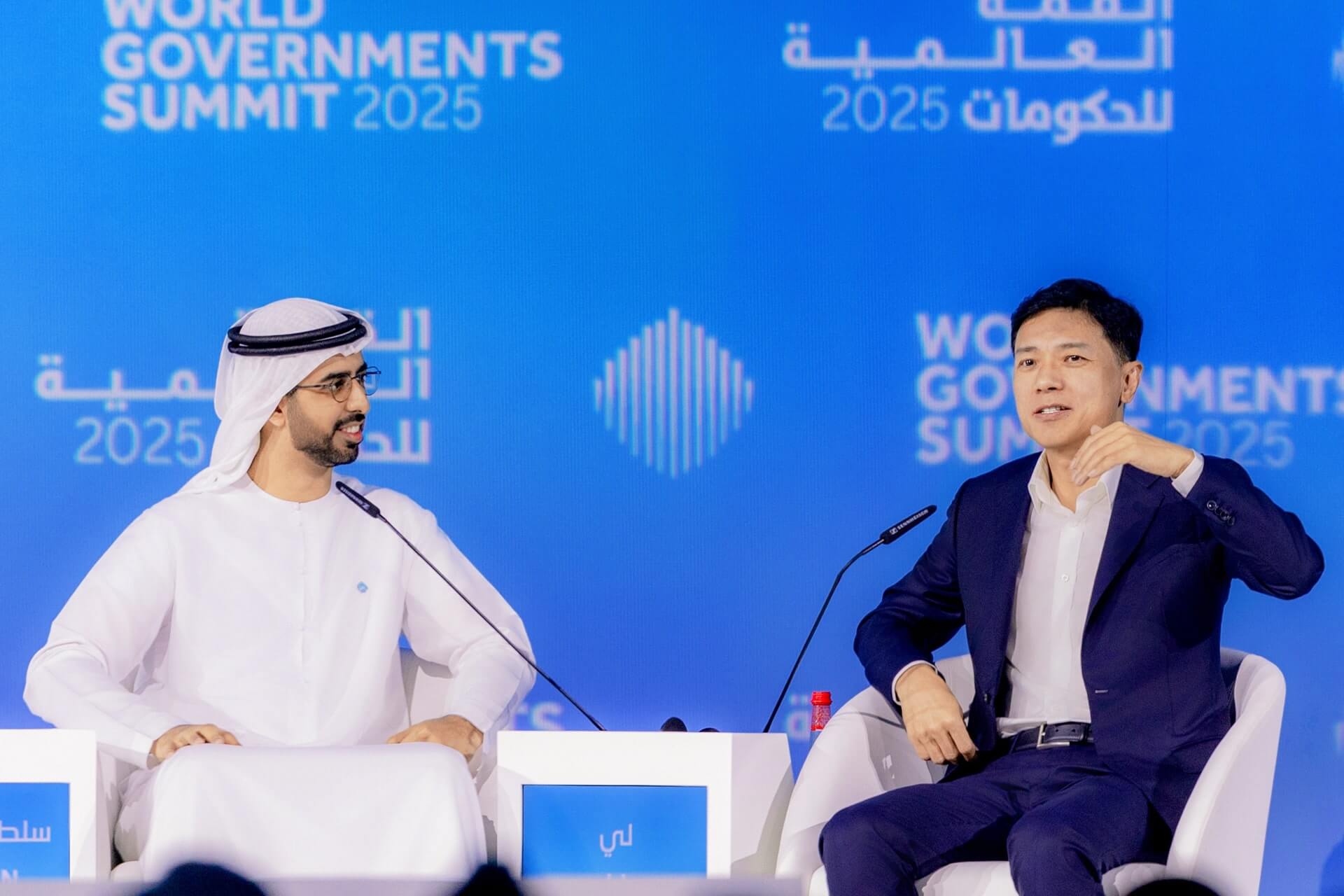

At the 2025 World Government Summit held in Dubai on February 11, Baidu founder Robin Li participated in a keynote dialogue with UAE’s Minister of State for Artificial Intelligence, Omar Sultan Al Olama. During the session, Li made a notable statement: based on real-world operation data, Baidu’s autonomous ride-hailing service “Apollo Go” has an incident rate just one-fourteenth that of human drivers—suggesting autonomous vehicles could be up to ten times safer.

Li revealed that Apollo Go has already completed more than 8 million autonomous trips in various Chinese cities, covering over 130 million kilometers without any major safety incidents. This performance has drawn global attention and sparked renewed confidence in the safety and scalability of autonomous driving.

Following the summit, Dubai Crown Prince Sheikh Hamdan bin Mohammed publicly acknowledged Li’s presentation on AI and the future of mobility. According to several sources, Baidu is currently in talks with the UAE government regarding the deployment of its autonomous taxi service in the Middle East. Apollo Go has also begun building teams and operations across Dubai, Abu Dhabi, Riyadh, and selected Southeast Asian markets.

This strategic move aligns with the broader vision of the UAE’s National Artificial Intelligence Strategy 2031, which includes a target for 25 percent of all transportation to be autonomous by 2030. Baidu’s entry into the Gulf region could mark a significant milestone in China’s autonomous driving globalization strategy.

McKinsey’s Future Mobility Research Center has reported that over 1 million people die in road accidents globally every year, with more than 90% of those accidents resulting from human error—fatigue, distraction, intoxication, or speeding. The firm believes that autonomous vehicles, powered by sensors and machine learning algorithms, can significantly reduce this risk. According to their projections, the safety of fully autonomous vehicles may exceed that of human drivers by up to a factor of ten.

Baidu’s Apollo Go appears to support this claim with compelling data. Its incident rate over the past two years has consistently remained at about 1/14 that of human drivers, reinforcing the potential of AI in ensuring safer transportation.

Currently, Apollo Go’s advantage is evident in cost efficiency, innovation, and international recognition. Central to these achievements is Baidu’s Apollo ADFM (Autonomous Driving Foundation Model), a large-scale AI model designed specifically for L4 autonomous driving.

In May 2024, Baidu unveiled Apollo ADFM—the world’s first L4-level end-to-end autonomous driving foundation model. This model enhances both safety and generalization, enabling vehicles to perform reliably in complex urban environments. Baidu claims that the model enables their robotaxis to outperform human drivers in safety by more than tenfold. Additionally, Apollo ADFM ensures 24/7 stability with “never offline, never inaccurate, always available” reliability.

Apollo Go’s sixth-generation unmanned vehicle is the first to fully integrate the “Apollo ADFM + hardware platform + safety architecture” solution. It features ten layers of redundant safety mechanisms and six sets of multi-redundant control strategies, reaching a safety standard that Baidu claims is comparable to China’s domestically produced C919 aircraft.

Baidu’s autonomous driving technology has not only made waves in China but has also garnered international acclaim. The sixth-generation Apollo Go vehicle was listed by Forbes as one of the “Top 10 Global Autonomous Driving Milestones” in 2024. It was also a finalist in the 2024 Edison Awards—the so-called “Oscars” of technology innovation—in the Driverless Vehicles category, ranking among the top three globally.

Beyond accolades, is actively expanding into global markets. In November 2024, it received Hong Kong’s first autonomous vehicle pilot license, marking its entry into a right-hand-drive, left-lane traffic region. The license is significant not only because of Hong Kong’s unique road system but also because it signals Baidu’s readiness to adapt to diverse international driving environments.

With autonomous driving entering a new phase globally, companies that have established strong domestic footholds are now looking outward. In this respect, Baidu appears to be moving faster than many of its competitors. According to industry insiders, Baidu has already launched talent recruitment and operational planning in cities such as Dubai and Riyadh.

Countries with high levels of urbanization—such as the UK, Japan, and Singapore—face challenges including an aging population, driver shortages, limited land, and increasing demand for efficient transportation. These conditions make them ideal early adopters of autonomous driving technologies. Accordingly, many of these nations have introduced regulatory frameworks specifically aimed at facilitating autonomous vehicle deployment.

The sixth-generation Apollo Go robotaxi is currently the world’s only mass-produced, factory-integrated L4 autonomous vehicle. Mass production not only guarantees vehicle consistency and stability but also significantly shortens deployment cycles. This gives Baidu a critical edge in bringing autonomous driving to new international markets quickly and affordably.

Apollo ADFM enhances the robotaxi’s generalization capabilities, allowing new city rollouts in as little as six months. This rapid deployment ability, coupled with cost efficiency, allows Baidu to enter new markets and scale services with unmatched speed.

Additionally, Baidu has built a comprehensive autonomous driving ecosystem by collaborating with suppliers and partners across hardware, software, data, and services. This ecosystem approach enhances its competitiveness and strengthens the foundation for broader adoption and commercialization.

The Middle East, with its strong economic capacity and openness to technological innovation, is proving to be an attractive launchpad. Several nations in the region have embedded autonomous driving into their long-term development agendas. The UAE’s vision for 2030 includes a strong commitment to smart mobility, while Qatar is piloting its own autonomous public transport systems.

According to a 2024 report from QY Research, the global autonomous vehicle testing market was valued at $1.39 billion in 2023 and is expected to reach $2.47 billion by 2030, with a compound annual growth rate of 8.7 percent. Meanwhile, Frost & Sullivan forecasts the global Robotaxi market will reach RMB 8.349 trillion (approx. $1.15 trillion USD) by 2030, with China alone accounting for RMB 4.888 trillion (approx. $675 billion USD).

While opportunities abound, challenges remain. International markets present variations in regulatory policy, road conditions, climate, and driving habits. These factors demand significant localization and adaptation. Furthermore, competition in the autonomous driving space continues to intensify. Global tech giants, including Waymo, Cruise, and Tesla, as well as Chinese players like Pony.ai and WeRide, are all investing heavily in R&D and market expansion.

To succeed globally, companies must demonstrate not only technical excellence but also operational scalability, government engagement, and the ability to meet regional compliance and safety standards.

In this context, Apollo Go’s aggressive overseas expansion and impressive safety record may well position Baidu as a leading global contender in the autonomous driving race. Its foray into the Middle East could become a blueprint for how Chinese technology firms navigate and shape the future of smart mobility worldwide.