At the IAA Mobility 2025 in Munich, CATL formally launched the Shenxing Pro—a cutting-edge lithium‑iron phosphate (LFP) battery tailored for the European electric vehicle market by offering exceptional range, longevity, rapid charging, and industry-leading safety.

Prior to 2015, Japanese companies dominated the lithium battery industry. In 2014, the top6 global lithium battery manufacturers were all Japanese firms, with South Korean and Chinese companies following. Panasonic held the top spot as the world’s largest battery producer. Elon Musk even referred to Panasonic as the “heart” of Tesla.

In that context, although Zeng Yuqun, CATL’s founder, had chosen the right path early on, the company remained overshadowed by global names—until around 2010. BMW began looking for a battery supplier for a pure electric vehicle to be sold in China. Logically, Panasonic—with Tesla’s backing—would have been the safest choice, but Brilliance‑BMW opted to seek a domestic supplier. They chose CATL, which had previously supplied Apple.

BMW had extremely stringent standards for battery production, sending CATL an over‑800‑page technical manual defining every detail—from electrode slurry ratios to clean‑room particulate levels. CATL’s staff conducted a comprehensive analysis of the over‑800‑page technical guidelines, ensuring the developed batteries met all the demanding criteria. Following this cooperation, CATL’s reputation surged, leading to partnerships with other major automakers, including Mercedes-Benz, Volkswagen, BAIC, and SAIC etc..

Though CATL grew rapidly, it also faced formidable competitors. In the international market, well-established companies with mature technology and ample funds had long targeted China. When Chinese battery system ex‑factory prices were around 2.5–3 RMB /Wh, tech‑leading firms like Samsung slashed prices to 1 RMB for 18650 (NCM ternary) batteries, using low-profit strategies to squeeze out Chinese suppliers.

In 2015, China’s MIIT( Ministry of Industry and Information Technology) introduced the “White List” regulation for electric vehicle power batteries. Only EVs using batteries from approved manufacturers could qualify for government subsidies. Although Samsung and LG had factories in China, they weren’t on the approved list, so their products couldn’t enter subsidized models and saw market shares rapidly decline. To qualify for subsidies, automakers had to choose domestic white‑listed battery suppliers. The policy remained until 2019 and significantly accelerated market share growth for companies like CATL and BYD.

Chinese new energy vehicle sales have led the world for six consecutive years. From January to September 2022, global NEV sales surpassed 7.26 million units, with China accounting for approximately 4.567 million units—62.9% of the total—and a cumulative vehicle stock of 10.99 million, roughly half of the global total.

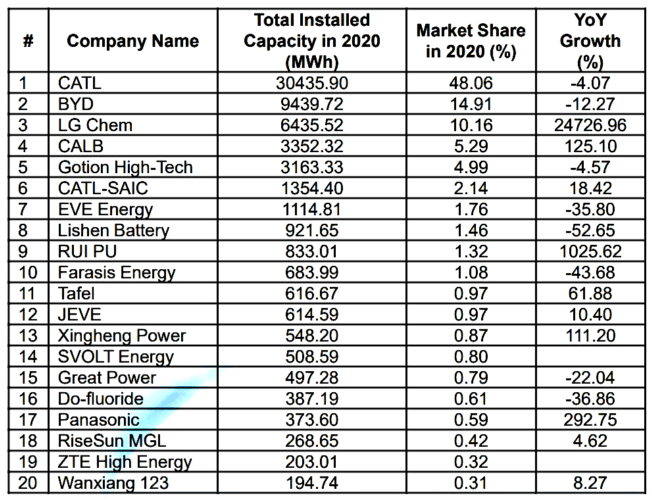

This vast market provided ample room for development. Coupled with its technological and manufacturing strengths, CATL overtook Panasonic in 2017 to become the world’s largest power battery maker. As Zeng Yuqun put it, “The Japanese invented lithium‑ion batteries, the Koreans scaled them, and the Chinese took them to the top.”

Today, beyond CATL as a flagship in the lithium new energy sector, Ningde also boasts other leading enterprises: SAIC in NEVs, Qingtan in stainless steel new materials, and Zhongtong in copper materials. These four pillar industries were carefully selected to interconnect and form a highly efficient industrial cycle. For example, nickel and cobalt from nickel laterite ore are key raw materials for lithium batteries; batteries are core components for NEVs; copper products are essential for automotive and battery manufacturing. Impressively, the Zhongtong project took only 17 months from construction to production, and the SAIC project—despite rainy weather on nearly 60% of days—also achieved the same timeline, setting a national benchmark for speed.

With such leading companies anchored in Ningde, over 30 lithium battery firms have relocated there, creating a rare clustering near downstream midstream manufacturers. The city now has two industrial clusters with output worth CN¥100 billion and two clusters worth CN¥10 billion. Ningde is forming a full closed-loop ecosystem—from raw materials to batteries to whole vehicles—which not only provides a solid industrial foundation for CATL, but also places Ningde in a unique position on the global new energy map.