In 2007, Transsion launched its first dual-SIM feature phone in Africa, the Tecno T780. In terms of functionality and design, this phone was not particularly remarkable in the global market at the time, but in Africa, it was highly innovative. That year, the T780’s annual sales in Africa exceeded 20 million units, making it a phenomenon in the African feature phone market.

At that time, the African mobile market was a vast blue ocean. For most Chinese smartphone manufacturers, the domestic Chinese market was growing rapidly, so few paid attention to Africa—a market with a population of over 1 billion but very low mobile penetration. Only Transsion, escaping the intense domestic competition, ventured to cultivate this new continent.

Today, as China’s domestic smartphone market reaches saturation and internet penetration in Africa rises, Transsion’s African stronghold has become highly attractive to other smartphone manufacturers.

However, the past two years have been challenging for Transsion. On one hand, competition in Africa has intensified—the blue ocean quickly turned red. On the other hand, new business growth points have been hard to find. In the African smartphone market, local purchasing power is limited, preventing higher profit margins. Meanwhile, supply chain costs have risen due to product storage price increases, and currency depreciation risks in Africa and South Asia directly impact profits.

Regarding new growth opportunities, Transsion has attempted to move into high-end smartphones, develop hardware-software ecosystems, expand into second-tier mobility, other digital products, and home appliances, or explore new emerging markets. All these steps require investment and patience before yielding returns.

Transsion must simultaneously maintain its current business and invest in new ventures. Life has been tight for the company. According to Transsion’s 2024 annual report, the company achieved revenue of RMB 68.715 billion in 2024, up 10.31% year-on-year. Net profit attributable to shareholders reached RMB 5.549 billion, a marginal increase of 0.22% year-on-year; net profit excluding non-recurring items was RMB 4.541 billion, down 11.54% year-on-year. Despite working hard, the company is experiencing revenue growth without profit growth.

According to Bloomberg, Transsion is considering a secondary listing in Hong Kong to raise around USD 1 billion, but the location, timing, and exact fundraising amount are still under discussion.

What kind of market is Africa’s leading mobile phone company facing today? Amid these challenges, where lies Transsion’s path to breakthrough?

In 2017, China’s smartphone market experienced a 4% decline in annual shipments—the first downturn after eight years of rapid growth and the first indication of market saturation. Market penetration gradually increased, and smartphone products matured. According to industry analyst Counterpoint, the average smartphone replacement cycle for Chinese users exceeded 31 months, compared with 16–18 months before 2019. “The Chinese smartphone market has fully entered a stock market. Without innovative products to attract users, the replacement cycle will only get longer,” said Hu Baishan, Executive Vice President and Chief Operating Officer of vivo.

This can be seen as a pause in China’s smartphone market, with competition among major manufacturers becoming nearly stable. By 2022, 618 shopping festival data highlighted the reality: Apple alone accounted for nearly half of total smartphone sales.

The nearly saturated market has led more Chinese smartphone manufacturers to look overseas for new growth, particularly in emerging markets. According to IDC, in 2024, global smartphone shipments reached approximately 1.24 billion units, up 6.4% year-on-year, rebounding after two years of decline. Chinese manufacturers captured much of this growth, and by Q4 2024, Chinese smartphones accounted for 56% of the global market, while Apple and Samsung saw their market shares decline.

In overseas markets, Africa’s smartphone growth has been rapid. According to market research firm Canalys, in 2025, Africa’s smartphone market got off to a strong start, with regional shipments growing for the eighth consecutive quarter. In Q1 2025 alone, smartphone shipments in Africa increased by 6 percentage points.

By 2025, African countries had strengthened policies to promote smartphone adoption.

In March, South Africa’s Ministry of Finance announced the removal of the 9% luxury consumption tax on smartphones priced below ZAR 2,500 (approximately USD 137), directly reducing the purchase cost for low-income groups. In April, the South African government launched the Affordable Smart Devices Program (ASDP), combining subsidies and tax incentives, requiring manufacturers to provide cost-effective smart devices, with the aim of freeing up spectrum resources for 4G/5G deployment. In May, South African telecom group MTN rolled out 4G phones to 1.2 million prepaid users in three phases, with the lowest price at just ZAR 99 (approximately USD 5.4). While Kenya and Nigeria do not have nationwide subsidy policies, mobile operators offer installment plans (e.g., OnPhone Mobile in Kenya, EasyBuy in Nigeria), lowering the barrier to smartphone adoption.

Since 2017, Transsion, which occupies half of the African market and is known as the “King of Africa,” has entered a period of rapid market growth, attracting more competitors. Ahead of the policy push mentioned above, in Q1 2025, Transsion’s market share in Africa was 47%, down 5 percentage points. During the same period, Samsung, Xiaomi, OPPO, and Honor ranked second to fifth in Africa, with market shares of 21%, 13%, 3%, and 3%, respectively.

Unlike before, when manufacturers simply sold phones to Africa through local distributors and operators, smartphone companies are now taking a deeper, more localized approach, attempting to replicate Transsion’s African experience. For example, Xiaomi’s best-selling models in Africa, the Redmi 10A and 12C, were priced at just USD 75 (approximately RMB 543) and USD 95 (approximately RMB 688) to suit local conditions. Canalys senior analyst Manish Pravinkumar noted that in Q4 2024, thanks to active market expansion in West African countries such as Cameroon and Ghana, as well as year-end consumer engagement events like the “Xiaomi Discount Carnival” in Egypt and “Xiaomi Fan Meet” in Nigeria, Xiaomi achieved 22% growth in Africa. Meanwhile, leveraging the momentum of the Note series, Realme achieved a 70% year-on-year increase in Q4 2024.

Overall, however, the challenges are temporary. Transsion’s core products and brand strength in Africa remain difficult to replicate. For example, in offline channels—the primary mode of purchase in Africa—Transsion has built a three-tier distributor system through partnerships with independent retail outlets, such as small family-run stores and wholesalers. This extensive distributor network also serves as one of Transsion’s main channels for obtaining first-hand market information.

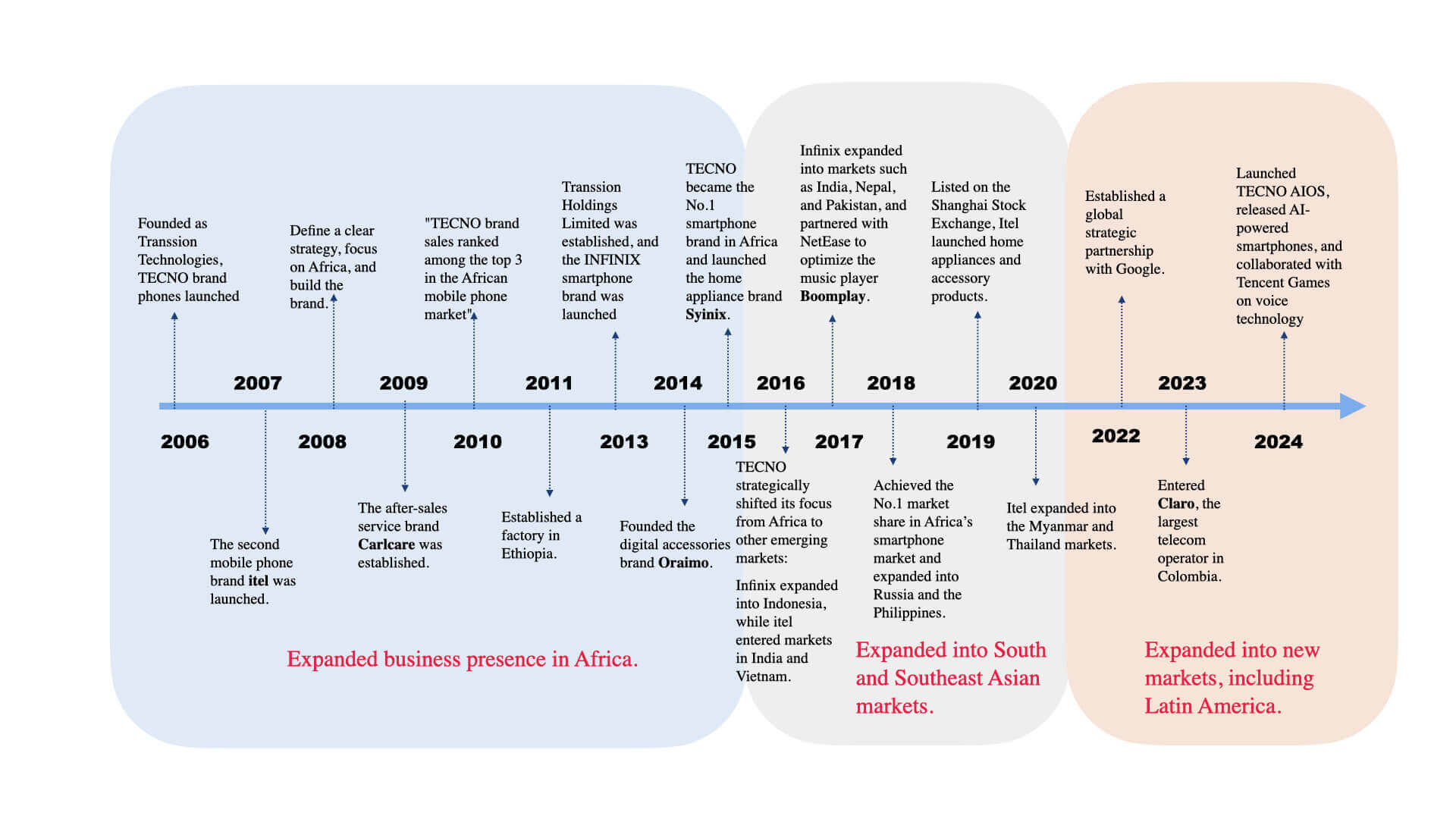

On top of its distribution network, Transsion has developed its own after-sales service brand Carlcare, home appliance brand Syinix, and 3C accessory brand Oraimo. Carlcare now has over 4,000 service points covering not only Africa but also the Middle East, Southeast Asia, and South America. Thus, even in remote areas, one can find small shops offering “phone repair + charging + top-up” services.

A 2022 research report on Transsion by Huaxin Securities stated: “Across the streets and alleys of Africa, whether on utility poles or walls, advertisements for Transsion’s mobile brands are everywhere—from the roads near Nairobi airport to the slums of Kampala, from the small border town of Kisii in Kenya to the tourist city of Rubevu in Rwanda. Wherever there are walls, Transsion’s wall ads can be found.”

In 2024, Transsion’s total revenue reached RMB 68.743 billion, with the African market contributing RMB 22.719 billion, nearly 40% of total revenue. Gross margin in Africa was as high as 28.59%, more than 10 percentage points higher than in other markets, highlighting the stability of Transsion’s African operations.

In fact, Transsion’s main challenges in Africa still come from pricing and local consumers’ purchasing power. In Africa’s smartphone market, entry-level smartphones under USD 100 (approximately RMB 719) account for 30% of sales, while mid-range smartphones priced between USD 100–199 (RMB 719–1,431) account for 42%, showing that the main consumer base is still in the low-to-mid segment. For Chinese manufacturers that competed in China, this involves a top-to-bottom strategy adjustment, with localization and building local operational capabilities being the main challenges.

For Transsion, whose base is in Africa, rising prices are limited. To find new market space, it must target higher-income consumer groups, which is even more difficult. BBK founder Duan Yongping once commented on Transsion: “This is a company with a ‘pragmatic’ gene, catering to the demands of a blue ocean market, but its business model moat is not wide enough. Its strengths lie mainly in channels and pricing, while weaknesses lie in technology and ecosystem.”

These are the challenges Transsion currently faces.

From Transsion’s current strategy, the company is attempting continuous breakthroughs. In Q1 investor Q&A sessions, Transsion stated that it will continue to expand its mobile business steadily, strengthen breakthroughs in mid- to high-end products, increase R&D investment, and focus on enhancing product value in imaging, AI, charging, and basic user experience, thereby improving the competitiveness of mid- to high-end products.

The paths for breakthrough are twofold: one is to explore more businesses and expand ecosystem value; the other is to enter more markets, taking Transsion’s brand beyond Africa.

Regarding business expansion, in recent years, Transsion has increased investment in new growth areas beyond mobile phones. For example, in the electronics sector, the digital accessories brand Oraimo, home appliance brand Syinix, and after-sales service brand Carlcare have extended the product range from phones to AI smart glasses, smart speakers, smart wristbands, TVs, air conditioners, washing machines, and more.

Additionally, to address the widespread power shortages in many parts of Africa, Transsion Holdings has invested in the research and development of energy storage-related products. There are also reports that Transsion has established a “Mobility Business Unit” and launched electric two-wheeler operations targeting the African and Latin American markets. Beyond hardware, Transsion is exploring the integration of software and hardware, collaborating with companies such as Google, Facebook, NetEase, and Tencent to develop independent apps like Boomplay, Scooper, and Phoenix, each surpassing tens of millions of monthly active users.

The expansion of multiple business lines has significantly increased Transsion’s R&D investment. In the first quarter of this year, R&D spending as a percentage of revenue rose by 1.08 percentage points compared to the same period last year. While these investments represent temporary costs, they are a necessary step for Transsion to build stability amid intensifying competition.

Transsion began exploring additional markets around 2016, with early targets including Indonesia, India, and Vietnam, primarily adopting low-price strategies. However, compared to Africa, these markets are more competitive due to higher population density and closer proximity to China, making it harder to establish a leading position locally. According to Transsion’s 2024 annual report, the gross margin in Southeast Asia was only 17.66%, reflecting revenue growth without substantial profit—essentially “small change” despite increased sales.

In recent years, Transsion has been further exploring opportunities in Latin America and the Middle East. For instance, it has introduced differentiated pricing strategies in the Middle East targeting various consumer segments and established long-term partnerships with local distributors in Latin America. However, as Transsion expands abroad, it faces the same competitors it encounters elsewhere—smartphone manufacturers are all venturing into new territories, and the time advantage that once belonged to Transsion in Africa is now hard to replicate.

Regardless, maintaining its stronghold in Africa, horizontally expanding into larger markets, and vertically deepening digitalization and intelligent innovations in Africa remain the only paths forward for Transsion.

Notably, an experience in Transsion’s African journey that all global companies can learn from is its capacity for deep localization and patience. For example, Transsion’s beauty-focused phones in Africa are designed to render darker skin tones with a smooth, chocolate-like finish in photos. To cater to Africans’ love for music and dance, Transsion has introduced phones with enhanced music features and randomly included over-ear headphones as a promotion. Moreover, for the hot African climate, it has released models that are heat- and drop-resistant.

In an exchange with ShineGlobal, Song Xin, founder of Xinfu Consulting, mentioned that the key to Transsion beating Apple and Samsung in Africa lies in creating phones tailored to African needs. Africans, having darker skin tones, have different photo preferences compared to other ethnic groups: while white people tend to want brighter, rosy skin tones, and Asians prefer slightly lighter tones without appearing pale, Africans have their own unique aesthetic. Transsion captured this, ensuring that African users look vibrant in photos. On the music front, Transsion’s music platform, Boomplay, features extensive works by local African musicians—something that other music services like Apple Music or Spotify struggle to achieve, as they do not finely segment by regional markets. Compared to Transsion, many products may initially achieve decent sales, but to truly resonate with consumers and command a premium, brands need to offer “psychological satisfaction,” making consumers feel that the product was crafted specifically for them rather than off-the-shelf surplus.

For more Chinese companies venturing globally, the simplest approach might seem to be winning the entire market with a standardized product. However, from the perspective of many practitioners, globalization is essentially localization—it is about integrating into, understanding, and deeply connecting with local consumers’ psychology and habits. Early overseas entrants had more time to adjust their strategies and pace, but now, markets are diverse while competitors are similar, often prompting brands to ignite their competitive drive before even landing. For patient long-term players, the key is having both the ability and courage to create time windows for themselves.