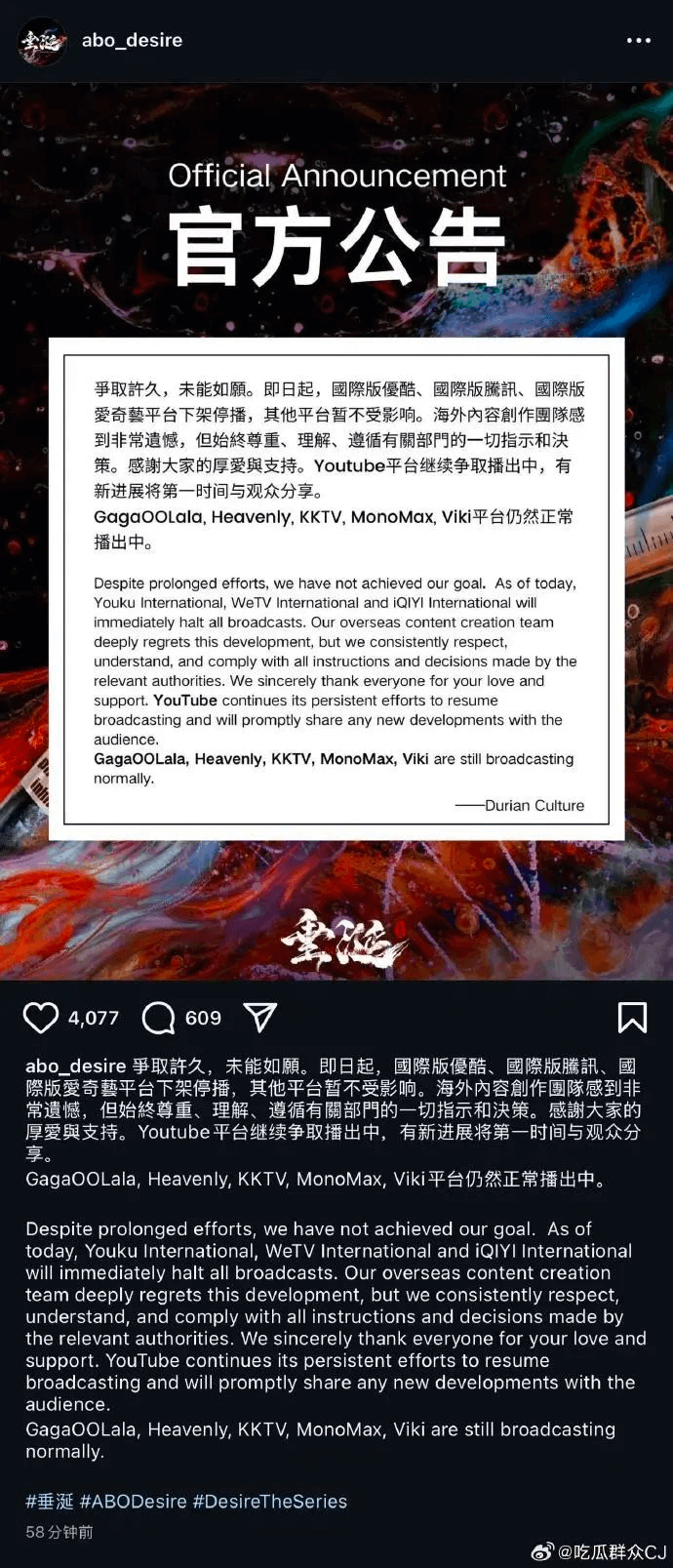

In recent years, Asian streaming services have been eager to replicate Netflix’s global expansion. Yet the challenges of crossing borders remain clear. In late July, the Chinese BL (Boys’ Love) drama Craving, produced by Durian Culture with a cameo by Hong Kong actor Jacky Heung, was pulled from three overseas platforms—WeTV (Tencent’s international version), iQIYI International, and Youku International—shortly after its release.

The incident reflects a broader reality: the strategy of relying on domestically produced BL dramas to capture overseas audiences has so far delivered limited results.

The Lukewarm State of China’s “Going Global” Push

When Chinese long-form video platforms first set their sights on Southeast Asia, the region seemed promising: a young population, growing spending power, and a deep appetite for entertainment. Yet over the years, the number of truly influential Chinese dramas or stars making an impact in the region has barely grown.

Following the global success of Squid Game, the “going global” movement entered a new phase. Netflix became the model for iQIYI, Tencent Video, and Youku, which adjusted their rollout pace, content strategies, and local partnerships. Years later, however, dominance in Southeast Asia remains elusive. Popular genres—BL dramas, romantic comedies, historical romances—are already saturated, while talent shows like Produce Camp Asia have had limited post-launch impact. Securing a slot on Netflix is still viewed as a major milestone for Chinese producers.

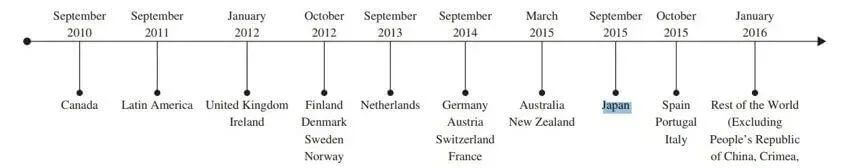

Why Netflix Started in Japan

Netflix’s 2015 entry into Japan was a calculated move based on four key factors:

Economic readiness – Japan’s per capita nominal GDP was $32,500, over four times China’s at the time, with a consumer market used to discretionary spending.

Market testing – Platforms like YouTube and Hulu had already established pricing models in Japan, paving the way for subscription-based services. Netflix adapted by offering three pricing tiers, starting at 650 yen (about $5.40).

Supportive environment – Government-backed digital innovation initiatives and the absence of a dominant local streamer created a market gap.

Cultural receptiveness – Decades of exposure to U.S. entertainment primed Japanese audiences for North American content. Partnerships with SoftBank, Panasonic, Sharp, and Sony even placed Netflix buttons directly on TV remotes.

In short, Japan offered a “downward compatible” entry point—advanced enough to sustain subscriptions, yet still open to new players.

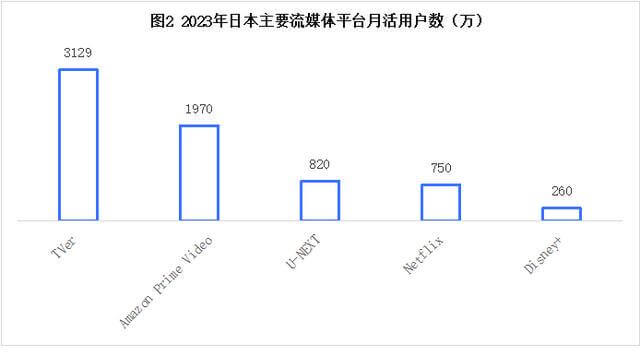

2023 Japan Main Streaming Media Platform MAU(10k)

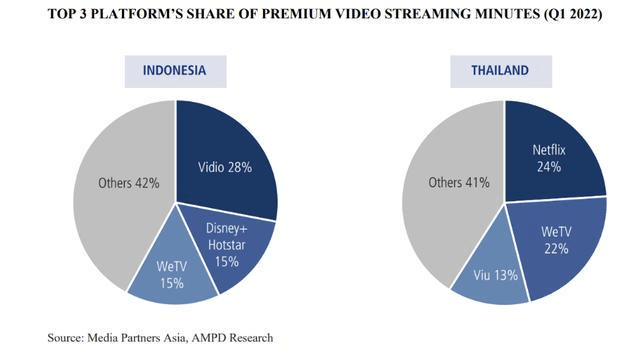

Why Chinese Platforms Chose Southeast Asia

Southeast Asia was similarly appealing: young demographics, rising incomes, and high entertainment consumption. Tencent entered by acquiring Thai web portal Sanook in 2016, while Alibaba took control of Lazada the same year. But a clear content strategy was slow to emerge.

Only around 2022 did Chinese platforms begin accelerating localization, borrowing from Netflix’s playbook:

iQIYI partnered with Thailand’s Be On Cloud on BL hits like KinnPorsche (2022), Bed Friend (2023), and The Luminous Solution (2024).

Tencent’s WeTV Thailand leaned on reality formats, launching Produce Camp Asia in 2023 and 2024.

iQIYI also co-produced a Thai version of Running Man with Korea’s SBS.

Despite these efforts, none have created a distinctive “brand” for Chinese platforms overseas. The most popular genres are already crowded, and local players maintain strong positions.

The Netflix Localization Playbook vs. Chinese Approaches

Netflix’s global expansion has relied on a three-step localization strategy:

Co-productions with local partners

Development of original local IPs

Embedding stylistic elements suited to local tastes

In Japan, this meant deals with top animation studios and adaptations of hit manga like One Piece. In Korea, Netflix combined local storytelling with edgier themes, producing global hits like Squid Game, The Glory, and Kingdom.

By contrast, Chinese platforms have yet to establish an equally recognizable “signature” content style abroad.

Structural Obstacles

The core challenges are financial and operational: Netflix’s budgets have transformed local industries—raising Korean drama budgets from 3–4 billion KRW to 20 billion KRW, with Squid Game Season 3 reportedly hitting 100 billion KRW; Higher budgets attract top talent, creating a virtuous cycle of quality and global appeal; Chinese platforms remain domestically focused, with fewer resources allocated to overseas originals.

Even regional hits like KinnPorsche did not significantly boost iQIYI’s subscriptions or ad revenue. Piracy further erodes the return on investment.

There are Possible Paths Forward:

Focus on genres with universal appeal – Suspense, thrillers, and crime dramas require less cultural adaptation and have proven export potential (Reset, The Long Night).

Expand to under-served regions – iQIYI’s push into the Middle East and North Africa, with partnerships like Etisalat’s STARZ ON and WATCH IT, may open new revenue streams.

Build a recognizable overseas content label – Beyond BL dramas and romantic comedies, platforms need a signature style that global audiences associate with Chinese streaming.